Electronic Arts Is A Strong Play In A Booming Industry (NASDAQ:EA)

Electronic Arts (EA) is one of the largest video game companies in the world. The company has some of the most diverse and well-known titles in the industry. While competition is ramping up dramatically from large and small players alike, EA continues to cement an increasingly strong foothold in the industry.

The Video Game Industry Is Healthier Than Ever

Video games are growing more popular than ever with the continual advancements being made in computer hardware and software technologies. Surprisingly, COVID-19 has done little to stop the momentum of the gaming industry. In fact, the pandemic may have actually bolstered major video game companies like EA and Activision Blizzard (ATVI). The social distancing norms and lockdowns that resulted from the pandemic have noticeably increased the appetite for gaming in general.

EA has been especially well-positioned during the pandemic given the popularity and diversity of its major titles. Moreover, EA has been particularly well-suited to fill in the entertainment gap that has emerged during the pandemic with its sports titles. Given how slow live sports have been to return, EA’s sports titles such as Madden NFL have allowed consumers to satisfy their general sporting needs to some degree.

Unsurprisingly, EA has performed very well in recent quarters. In fact, EA grew its Q1 net bookings of $1.39 billion by 77% Y/Y. Despite EA’s recent downturn, the company’s long-term prospects remain stronger than ever. Video games are taking an increasingly large share of the entertainment industry, and EA is in a prime position to benefit from this trend.

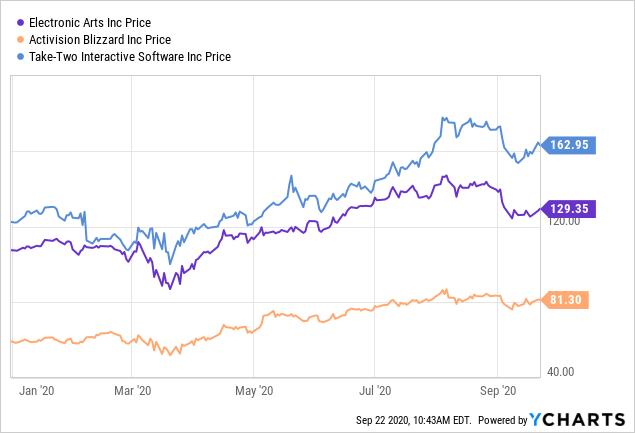

EA, along with other major video game companies like Activision Blizzard and Take-Two (TTWO), has performed incredibly well during the pandemic.

Data by YCharts

Data by YCharts

Source: YCharts

Strong Sports Presence

EA has cemented an incredibly strong foothold in the fast-growing sports gaming niche. The company’s dominance in sports video games with franchises such as FIFA, Madden, NHL, and EA Sports UFC are unrivaled by any other video game company. Moreover, EA has no ties to a singular platform, which means that its sports games have greater access to a broader audience.

EA’s exclusive gaming rights with many of the world’s top sporting organizations gives the company an even greater moat in sports gaming. The fact that EA has such large sports gaming markets locked down gives the company an advantage over competitors.

Top sports titles such as FIFA are nearly guaranteed to be huge moneymakers for EA and give the company a higher degree of stability and predictability. While Take-Two is starting to offer some serious competition in sports gaming with its NBA 2K franchise, EA will likely maintain its dominance in sports gaming for the foreseeable future.

Balance Sheet

EA has one of the strongest balance sheets in the industry. The company continued to bolster its balance sheet in its latest quarter. In fact, EA generated $378 million of net cash from operating activities and over $2 billion TTM in net cash. This brings the company’s cash and cash equivalents to an impressive ~$4 billion. EA also has very little debt on its balance sheet.

Given the growing development costs of video games, EA’s robust balance sheet gives the company an edge in the increasingly competitive video game industry. Development cost for AAA games, in particular, are skyrocketing to unprecedented levels. As AAA titles now regularly cost hundreds of millions of dollars to make, poor performance on such titles could be devastating for many companies. However, EA has far greater room for error given the strength of its balance sheet.

AAA games are becoming far more expensive to make. Destiny, for instance, cost ~$500 million to develop and market.

Source: Destiny

Source: Destiny

Increasingly Competitive Landscape

The video game industry is starting to attract far more competition. EA is facing increasingly tough competition not only from large pure plays like Activision Blizzard, but also from some of the largest technology giants like Microsoft (MSFT). In fact, Microsoft recently made big news by acquiring ZeniMax Media for $7.5 billion.

ZeniMax Media is the parent company of renowned video game publisher Bethesda, which owns beloved franchises such as Elder Scrolls and Fallout. This acquisition only cements Microsoft as a gaming powerhouse. Even Amazon (AMZN) is starting to make big moves in gaming with its Amazon Game Studios division. EA is clearly set to face increasingly stiff competition in the years to come.

Technology giants like Microsoft are starting to represent a serious competitive threat to EA. The company now owns renowned titles such as Elder scrolls with its acquisition of ZeniMax Media.

Source: Elder Scrolls

Source: Elder Scrolls

Conclusion

EA still has more upside at its current market capitalization of ~$36 billion and forward P/E ratio of ~23. The company even appears to be cheap compared to some of its major competitors like Take-Two. EA is well-situated to take advantage of the major secular trends in the gaming industry as one of the most diverse and financially robust companies in the industry.

Disclosure: I am/we are long TTWO. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The Y/Y figure is indeed 77%. I think I may have accidentally used a net booking guidance figure to calculate the Y/Y growth.